How to Get Investors for Your Cannabis Company

Welcome to our comprehensive guide to what you will need to do a private placement offering of an equity interest in your cannabis company – we hope you find this informative. Feel free to contact us with your questions about raising money for your cannabis company.

Get Started on Your Cannabis Business Next Steps Here.

Looking for Dispensary Information – Click Here.

Looking for Grower Information – Click Here.

“How to Raise Capital for your Cannabis Company” means your team has taken the extra steps to become legitimate. They have realized they need access to capital and so are preparing the various plans, financial projections and contracts you need to be taken seriously by sophisticated accredited investors.

RELATED POST: Getting a Job in the Cannabis Industry

Top Five Online Resources to Apply for Capital for Your Cannabis Company

Not everyone needs to raise funding in the cannabis industry – but well over 90% of the teams do need more funding. If you have not secured about a million dollars for your dispensary and at least 3 to 6 for your cultivation companies, then you should consider raising more capital. Below are five online resources for your team to review. Hope it helps you put together the most complete and competitive application that your team can.

How to Value Your Cannabis Company – Post License Award

Hi, I’m Tom and you can find me by searching for cannabis lawyer and clicking over to my website cannabis industry lawyer.com – a resource for learning more about the industry that you want to get into – This is a fairly complex episode and start of a series that deals with finance and fundraising for your business – it will be advantageous to watch until the end and if you hang out until then, you’ll learn why I know all this crap.

Today we are starting our first of a multipart series that will be in our playlist called Fundraising. If you are getting into the cannabis industry and you are under a million dollars for your dispensary team, or under 4 million for your craft or micro grower team – then this is the playlist for you.

In our first episode we will talk about the valuation of your business so you can understand how to structure a private placement offering with your business valued at the post license price and not the application price.

Your cannabis license has two valuations, pre-award and post award. In our research, we are going to continue to gather data regarding how much winners spent on their pre-award license costs. However, we anticipate that that will in the hundreds of thousands, probably about 200,000. Think about everything that you can buy to put into the best application – and what do we mean by best application.

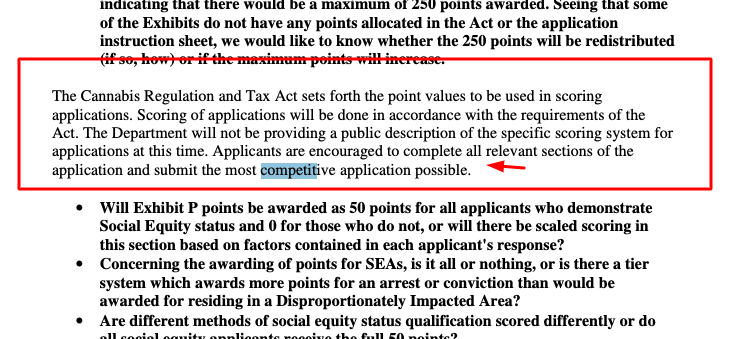

Let’s look at the typical answer the state of Illinois gave, which will be similar to your state if you have a competitive cannabis licensing process. They want the most complete and competitive application that you can have.

Think of all the professionals you have to hire for getting your cannabis company ready to be successful in raising capital.

- Lawyers,

- accountants,

- MBAs,

- architects,

- consultants for cannabis operations,

- clerical staff to keep track of the complexity,

- teams to go out into the community to gather support from its citizens,

- literally everything that you need to do have your business be ready to – except for the award of the license.

- That gets really expensive.

On average, dispensaries cost less than cultivation – but real estate and opulence could conceivably make it the apple store of dispensaries cost millions of dollars – we do not recommend this avenue for your team.

Still you have a pre-application cost of tens of thousands, if not low hundreds of thousands of dollars in organizational costs and fees to get your team to a point where it can legitimately compete for a small amount of licenses.

After you have spent this time and effort to get your team together and your application in order, you have a better chance of winning and a more realistic sense of how much of your company you should have held onto. In Illinois, we have social equity concerns that often dictate how the company is structured. Stay tuned in this series for more information on operating agreements, and social equity operating agreements.

The amount of time and money you spent pre-award of the license is the valuation of your company before you have the right to do any business with cannabis. You do not want to sell your company at that valuation.

Instead, you want to approach your investors with a post-license award valuation so that their infusion of money to pay for the buildouts to opening your doors for business does not result in them taking too much of the business away from the team that was required to win the license.

Many states have diversity and social equity requirements that really dictate how the team is to be brought together, or talent is in scarce resource and so the classic ‘smart-rich” business combinations occur frequently in the cannabis industry.

The more your team presents the rich investor with a packaged deal that he or she can understand – the more likely you are to get that commit from them so when you win, they fund.

How much is a dispensary or a grow worth? Well, depends on a multitude of factors like the available canopy space to produce buds, or how much population your dispensary can serve. They do not really have averages, but you can look at cash flows and deduct expenses to get a net cash flow that you can put a multiple on to get a ballpark figure on how much you should value your dispensary or grow.

How To Use Seller’s Discretionary Earnings to Value your Cannabis Company

Let’s first set some parameters in this model that you will use to determine how much you should charge for an interest in your cannabis company. We will use Seller’s Discretionary Earnings, which is basically your net earnings, plus any salary you paid the owners added back in. This is net income before taxes – I’m not sure if we want to use that, or to net out the taxes and just add another multiplier.

For example, the average small business in america sells for 2.76 times SDE – Seller’s discretionary earnings – If we added the taxes into the equation to just get at the net and truly free cash flows, then we could value the business at 3.76 times if we include the tax liability already.

This valuation is getting closer to EBITDA (earnings before interest, taxes, depreciation and amortization) the average on those valuations is about 4 to 6 times – but this method is more for larger companies where the owners salary and benefits are far less of a dent than for small businesses worth less than 20 million dollars or so.

So what can a dispensary net – in a ballpark figure – assume a population of about a quarter million people and an average sale of 50 dollars??

Quite a lot actually, between 300 and half a million a month. And it could net, after paying taxes and all expenses, like costs of goods sold and wages, about 100 to 150 grand. So you are talking about over a million dollars of free cash a year. And you can probably get the regular dispensary open for business for about 200-300,000. Little more – little less – these are ballpark figures that are okay for valuing your business for the purposes of investors.

So put together your startup budgets for your dispensary at 500 to 1 million dollars. And, for example, assume $1,800,000 of net free cash per year – or SDE including tax – we multiply it by 3.5 and get a valuation of your dispensary of $6.3 million.

Remember, you probably only need to raise 500,000 to one million dollars for your dispensary. So let’s say you go for the cool million – what should you sell your company at?

That comes out to being about 16% – maybe you need to up their deal – well, you can offer a convertible debt that pays them back their investment, and gives them an equity stake – or maybe you just make the simpler offer of – I’ll give you 20% of my dispensary for 1 million.

The best part for the investor is they do not have to pay, until you get the license. Now, again, the application itself may cost about 100 grand. So you can use options to defray that cost by saying, hey Mr. Millionaire – for 25 grand – I will give you the right to own 20% of our dispensary, which will require you to fund a note upon our win.

Okay, now let me get my craft grower proformas – just a second, but if you are liking this content and finding it valuable, smash them thumbs up and subscribe – then share it with someone on your team.

Okay, well the grower proformas are of course completely different – they are dependent on the output yield you can sell with your canopy space more than the total amount of transactions that your dispensary can service. And I’d like to give a shout out to Green Growth CPAs for helping us our with our proformas for the craft growers. Check out their episode, right here.

We figure that your free cash flows, even after you pay taxes and any profits to employees and the community – you will have about 1.5 to 2 million dollars depending on your yield. So does that mean that a grower license is worth as much as a dispensary license? No. You have to look at the upper limit of your campoy or plant number.

A 5,000 square foot flowering canopy may yield about 200 to 250 pounds a month.

But the license allows you to flower up to 14,000 square feet of canopy space if you work with the state and be a good grower. That means your free after tax cash flows may be 2 to 3 times higher than the 1.5 to 2 million. So you can see that your grower venture could be worth over ten million depending on your yield and wholesale price point.

How much is it to build out the high quality indoor grow – a lot. You can try to cut corners, but you won a license by promising to build a high quality indoor farm that has automation, high security and various levels of humidity control in buildings within a building.

Three to six million dollars – and higher – should be not only budgeted for, but also funded. Get the funding by knowing how to make the offer to the investor on what it costs to get in, and what their upside potential is.

Using Pro Forma Cash Flows to Value Companies Has Its Limitations

Of course – Be honest – these are just pro forma cash flows. They are estimates – but with them we can honestly explain to an investor – an accredited investor at that – that the financing available to fund your build will still require a substantial downpayment. So you will have to raise a couple million dollars to get some leverage to cover the rest.

If you want help ballparking your figures and how to help raise funds for your cannabis business. Like this video and head over to cannabis-industry-lawyer.com with your questions.

Now that you know how to value your company post license, and sell percentages to your wealthy team members accordingly – next we will discuss your organizational structure when we cover – operating agreements. Especially when dealing with social equity.

Thomas Howard has been in business for years and can help yours navigate towards more profitable waters.

Our cannabis business attorneys are also business owners. We can help you structure your business or help protect it from overly burdensome regulations.