If you’re an entrepreneur looking to enter the booming medical marijuana industry in Kentucky, you’ve come to the right place. With the recent passage of Senate Bill 47, also known as the Kentucky Medical Cannabis Act, opportunities for cannabis businesses are on the rise. In this comprehensive guide, we’ll provide an overview of Kentucky’s medical marijuana laws and explore the business prospects that await you in this emerging market.

If you’re an entrepreneur looking to enter the booming medical marijuana industry in Kentucky, you’ve come to the right place. With the recent passage of Senate Bill 47, also known as the Kentucky Medical Cannabis Act, opportunities for cannabis businesses are on the rise. In this comprehensive guide, we’ll provide an overview of Kentucky’s medical marijuana laws and explore the business prospects that await you in this emerging market.

Overview of Kentucky Medical Marijuana Laws

The legalization of marijuana in Kentucky is a significant milestone for both patients and entrepreneurs alike. Senate Bill 47 allows for the use of medical marijuana to treat various qualifying conditions such as cancer, chronic pain, epilepsy, multiple sclerosis, and HIV/AIDS.

Kentucky Medical Cannabis License (May 2024 Update)

Kentucky is opening its doors to medical cannabis businesses! Applications for licenses kick off on July 1st, 2024. This guide simplifies the process for you, whether you’re a seasoned entrepreneur or new to the cannabis industry.

Key Dates and Info

- Applications Accepted: Starting July 1st, 2024

- License Selection: Random lottery system to award a total of 76 licenses in 2024

- Social Equity: No specific requirements for social equity

- First Dispensaries: Expected to open in 2025

Choosing Your License Path

Kentucky offers various licenses to suit your business goals. Here’s a breakdown of the options and fees:

- Cultivation Facilities:

- Tier I (grow space under 2,500 sq ft): $3,000

- Tier II (up to 10,000 sq ft): $10,000

- Tier III (up to 25,000 sq ft): $20,000

- Tier IV (up to 50,000 sq ft): $30,000 (No licenses available in 2024)

- Processing License: $5,000

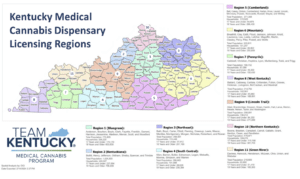

- Dispensary License: $3,000 (with quotas: 4 per rural region, 6 in Louisville & Lexington regions)

- Producer License (cultivation & processing): Cultivation tier fee applies, plus $5,000

- Safety Compliance Facility License: $3,000 (unlimited licenses)

Gearing Up for Your Application

The application process requires you to demonstrate your qualifications. Here’s what you’ll need:

- Secure Funding: Show proof of at least $150,000 in funding for each region you apply in. Each region needs a unique funding source.

- Secured Location: Lease, purchase agreement, or deed for your facility is required. The location must comply with zoning and be at least 1,000 feet from schools/daycares.

- Ownership Transparency: Provide details for all owners, including name, date of birth, CV/resume, contact information, and address. Documentation showcasing business experience in Kentucky or the cannabis industry is mandatory.

- Medical Professional Disclosures: Disclose financial information for any backers and involved medical professionals.

- Business Plans & Documents: Submit your Articles of Incorporation, Bylaws, and other relevant formation documents.

- Operational Plans: Develop detailed plans covering job descriptions, operational timeline, financial plan, security measures, transportation, storage & inventory management, recordkeeping, diversion prevention, and workforce development.

Navigating Kentucky’s Regions

Overview of Kentucky Medical Marijuana Laws

Kentucky passed Senate Bill 47 in its House of Representatives and Senate, legalizing medical marijuana for eligible conditions such as cancer, chronic pain, and epilepsy. The bill establishes a comprehensive regulatory system for the cultivation, processing, and dispensing of medical cannabis. Starting in 2025, patients with a medical marijuana card can purchase products from licensed dispensaries. A 6% tax on sales will fund drug treatment programs and related services.

Senate Bill 47 passed in Kentucky to legalize medical marijuana for various conditions including cancer and chronic pain. The bill creates a state program overseeing cultivation, processing, and dispensing through licensed facilities. Patients need a state-issued card to purchase cannabis products from dispensaries while generating tax revenue that supports drug treatment programs. Implementation begins in 2025 after the licensing process commences this summer

Passage of Senate Bill 47

Senate Bill 47, also known as the Kentucky Medical Cannabis Act, was passed by the state legislature and signed into law by Governor Andy Beshear. The bill legalizes medical marijuana for conditions such as cancer, chronic pain, epilepsy, and HIV/AIDS. It establishes a regulatory system for cultivation, processing, and dispensing of medical marijuana through licensed dispensaries. The bill also imposes a 6% tax on sales to fund drug treatment programs.

The Kentucky Medical Cannabis Act, also known as Senate Bill 47, has been signed into law. This groundbreaking legislation legalizes medical marijuana for conditions such as cancer and chronic pain, providing much-needed relief to those in need. With the implementation set to begin in 2025, this victory is a ray of hope for adults suffering from debilitating conditions like chronic pain.

The implementation of SB 47 will begin in 2025. However, licensing for cultivators and processors can start after the election for Governor in 2023 if Andy Beshear is re-elected. This comprehensive legislation is a significant victory for medical marijuana advocates in Kentucky and the Marijuana Policy Project said it expected it to benefit many adults suffering from debilitating conditions like chronic pain.

Key Provisions of SB 47

- Licensing requirements for medical marijuana businesses: The bill creates a state regulatory system for the cultivation, processing, and dispensing of medical marijuana. Licenses will be issued to cultivators and processors, with oversight from the Department of Agriculture.

- Regulations on product safety and testing standards: Medical marijuana will need to meet specific safety and testing standards before it can be dispensed. This ensures that patients have access to high-quality and safe products.

- Restrictions on advertising and marketing practices: The bill includes provisions that limit advertising and marketing practices for medical marijuana businesses. This helps prevent excessive promotion while ensuring responsible use by adults.

Overall, SB 47 provides comprehensive guidelines for licensing, product safety, testing standards, and advertising restrictions in Kentucky’s medical marijuana industry. These provisions aim to support patient access while maintaining a regulated market focused on public health.

Eligible Conditions for Medical Marijuana

List of qualifying medical conditions in Kentucky: The Kentucky Medical Cannabis Act allows for the use of medical marijuana to treat conditions such as cancer, chronic pain, epilepsy, multiple sclerosis, and HIV/AIDS.

Requirements for obtaining a medical marijuana card: Patients must be adults diagnosed with a qualifying condition by a licensed physician. They can then apply for a medical marijuana card from the state in order to access cannabis treatment.

Process for healthcare professionals to recommend cannabis treatment: Licensed physicians are responsible for diagnosing patients with qualifying conditions and recommending medical marijuana as part of their treatment plan.

Cultivation, Processing, and Dispensing of Medical Marijuana

Insights into the cultivation licensing process: Kentucky’s medical marijuana program, established by Senate Bill 47, requires cultivators and processors to obtain licenses. The Department of Agriculture will oversee the licensing process for these businesses.

Regulations on cultivation techniques and facility requirements: Cultivators must adhere to state regulations regarding cultivation techniques and facility requirements. These regulations ensure that cannabis is grown in a safe and controlled environment.

Distribution channels and dispensary regulations: Medical marijuana will be distributed through licensed dispensaries. Patients must obtain a medical marijuana card from the state to purchase cannabis from these dispensaries. Strict regulations are in place to ensure proper distribution practices are followed.

Taxes on Medical Marijuana Sales

Overview of tax rates imposed on cannabis sales: The Kentucky Medical Cannabis Act imposes a 6% tax on the sale of medical marijuana at dispensaries. This tax revenue will be utilized to fund drug treatment programs and other related services.

Implications for business owners’ financial planning: Business owners in the medical marijuana industry need to consider the 6% tax when developing their financial plans. They should factor in this additional cost and ensure they have appropriate strategies in place to manage their finances effectively.

Reporting obligations under the taxation framework: Business owners are obligated to report and pay taxes on their medical marijuana sales according to the taxation framework established by the Kentucky Medical Cannabis Act. It is essential for business owners to understand and comply with these reporting obligations to avoid any legal or financial consequences.

Implementation and Effective Date

The Kentucky Medical Cannabis Act, also known as Senate Bill 47, was signed into law by Governor Andy Beshear on March 31, 2023. The effective date of the law is January 1, 2025. However, the licensing process for cultivators and processors can begin as early as this summer. This implementation timeline gives entrepreneurs time to prepare for the opening of medical marijuana businesses in Kentucky and ensures a smooth transition into legalized cannabis operations.

Start of Licensing Process

Application Requirements: To start the licensing process for cultivators and processors in Kentucky, applicants must meet certain requirements. These include submitting a detailed application with information on their business plan, security measures, and financial stability. Additionally, applicants will need to demonstrate compliance with zoning regulations and provide documentation of relevant experience or expertise in the industry.

License Types and Categories: The state regulatory system created by SB 47 offers different license types and categories for cultivators and processors. This allows businesses to choose the specific area they want to operate in based on their capabilities and goals. For example, there may be separate licenses for outdoor cultivation, indoor cultivation, processing facilities, or dispensaries.

Background Checks and Financial Disclosure: As part of the licensing process, applicants will undergo thorough background checks to ensure they meet all legal requirements. This includes criminal history checks at both state and federal levels. Additionally, applicants will need to provide detailed financial disclosure statements that demonstrate their ability to operate a cannabis business effectively while complying with tax laws.

By meeting these application requirements, selecting an appropriate license type/category,and successfully passing background checks/financial disclosure procedures, Cannabis entrepreneurs can move forward in obtaining licenses within Kentucky’s medical marijuana program under SB 47.

Effective Date of the Law

Timeline for Implementation: The implementation of the Kentucky medical marijuana program will begin on January 1, 2025. However, the licensing process for cultivators and processors can start as early as this summer.

Transition Period for Existing Businesses: Existing businesses in Kentucky will need to obtain a license to cultivate or process medical marijuana in order to continue their operations once the law goes into effect. They should prepare for the transition period by familiarizing themselves with the new regulations and requirements.

Key Deadlines and Milestones: Entrepreneurs interested in starting or operating a cannabis business in Kentucky should be aware of key deadlines and milestones. This includes submitting license applications during the designated time frame, meeting regulatory requirements, and preparing for inspections prior to obtaining a license.

By understanding these important dates and milestones, entrepreneurs can plan ahead effectively and ensure compliance with Kentucky’s medical marijuana laws when establishing their cannabis businesses.

Definition of a Qualified Patient

A qualified patient in Kentucky is an adult who has been diagnosed with a qualifying medical condition by a licensed physician. These conditions include cancer, chronic pain, epilepsy, multiple sclerosis, HIV/AIDS, intractable nausea, post-traumatic stress disorder (PTSD), severe muscle spasms, and any other condition determined by the Kentucky Center for Cannabis to be qualifying. Qualified patients are allowed to possess a three-day supply of medical marijuana.

There are certain limitations and requirements for qualified patients. The sale of raw plant material and vaping products is prohibited under the law. Products containing more than 0.3% THC are also not permitted for sale to qualified patients. Additionally, medical marijuana must be dispensed in child-resistant packaging as per the bill’s requirements.

Qualifying Medical Conditions

Cancer and chronic pain, neurological disorders, and terminal illnesses are among the conditions that qualify patients for medical marijuana use in Kentucky. This new law provides relief to those suffering from these debilitating conditions by allowing them access to this alternative treatment option.

Cancer and Chronic Pain: Patients diagnosed with cancer or experiencing chronic pain can now benefit from medical marijuana in Kentucky. This natural remedy has been shown to alleviate symptoms such as pain, inflammation, and nausea associated with these conditions, providing much-needed relief.

Neurological Disorders: Individuals with neurological disorders like epilepsy or multiple sclerosis can now find hope in the form of medical marijuana. Studies have demonstrated its potential effectiveness in reducing seizures and managing muscle spasms commonly experienced by individuals with these disorders.

Terminal Illnesses: The new Kentucky law also extends compassion to those facing terminal illnesses. Medical marijuana can offer palliative care by alleviating symptoms such as severe pain, nausea, loss of appetite, and anxiety often associated with end-of-life situations.

By including cancer and chronic pain along with neurological disorders like epilepsy and multiple sclerosis under qualifying conditions for medical marijuana use, this legislation offers a lifeline for many patients seeking alternative treatments. Additionally extending its benefits to those facing terminal illnesses acknowledges the importance of compassionate care during challenging times.

Possession Limits and Prohibited Products

Maximum possession limits for patients: The bill limits the amount of medical marijuana that a qualified patient can possess to a three-day supply.

Restrictions on edible products: The bill prohibits the sale of raw plant material, vaping products, and products that contain more than 0.3% THC.

Prohibited cannabis-infused products: The bill prohibits the sale of raw plant material, vaping products, and products that contain more than 0.3% THC.

Packaging and Dispensing Requirements

Child-resistant packaging guidelines: To ensure the safety of children, medical marijuana products must be dispensed in child-resistant packaging. This requirement aims to prevent accidental ingestion and keep cannabis products out of the hands of minors.

‘Exit bag’ requirements for dispensaries: Dispensaries are required to provide customers with “exit bags” that meet specific criteria. These exit bags are used to securely store purchased cannabis products and ensure they are transported safely.

Labeling regulations for medical marijuana products: Medical marijuana products must comply with strict labeling regulations. Labels should include important information such as dosage instructions, THC content, potential side effects, and warnings about use during pregnancy or while operating machinery. Clear and accurate labeling is crucial for consumer safety and informed decision-making.

Business Opportunities in Kentucky’s Medical Marijuana Industry

With the passage of Senate Bill 47, entrepreneurs have the opportunity to enter Kentucky’s medical marijuana industry. The bill allows for cultivation and processing licenses, creating an avenue for businesses to grow and process medical marijuana. Additionally, licensed dispensaries will play a crucial role in distributing medical marijuana to qualified patients, presenting further business opportunities within the industry.

Tax implications are also important considerations for entrepreneurs looking to operate cannabis businesses in Kentucky. SB 47 imposes a 6% tax on the sale of medical marijuana, with revenue going towards drug treatment programs and related services. Understanding these tax implications is essential for entrepreneurs planning their financial strategies within this growing market.

Overall, Kentucky’s legalization of medical marijuana opens doors for budding entrepreneurs interested in entering this emerging industry by obtaining cultivation or processing licenses or establishing licensed dispensaries while also navigating potential tax obligations effectively.

Cultivation and Processing Licenses

Types of cultivation licenses available in Kentucky:

- Cultivators can obtain a license to grow medical marijuana for the state program.

- Processors can obtain a license to process medical marijuana into various products.

Requirements for obtaining a cultivation license:

- Applicants must meet certain criteria and pass background checks.

- They must show their ability to comply with regulations, including security measures, record keeping, and product quality control.

Regulations on processing cannabis products:

- Processors must adhere to strict guidelines regarding manufacturing processes, labeling, and packaging.

- Testing requirements ensure that all processed cannabis products are safe for consumption.

Licensed Dispensaries

Process for obtaining a dispensary license in Kentucky: Entrepreneurs looking to open a licensed dispensary in Kentucky must go through the licensing process. This involves submitting an application to the state, meeting certain requirements such as background checks and financial disclosures, and paying applicable fees. The Department of Agriculture will review applications and issue licenses to successful applicants.

Location requirements for dispensaries: Licensed dispensaries in Kentucky must meet certain location requirements. They cannot be located within 1,000 feet of a school, church, or daycare center. Dispensaries must also comply with zoning regulations set by local jurisdictions.

Compliance guidelines for operating a licensed dispensary: Once granted a license, operators must comply with strict regulations to maintain their license status. These include following security protocols to prevent theft or diversion of marijuana products, maintaining accurate records of inventory and sales transactions, ensuring product quality and safety through testing procedures, and adhering to advertising restrictions imposed by the state.

Operating a licensed dispensary requires careful attention to compliance guidelines while providing safe access to medical marijuana for eligible patients in Kentucky’s newly legalized program.

Tax Implications for Cannabis Businesses

- Overview of tax obligations for cannabis businesses in Kentucky

- 6% tax on the sale of medical marijuana

- Tax revenue used to fund drug treatment programs and related services

- Understanding sales and excise taxes on marijuana products

- Sales tax applies to the purchase price of medical marijuana products

- Excise tax imposed specifically on the sale or transfer of marijuana products

- Tax incentives or deductions available to marijuana businesses

- No specific tax incentives or deductions mentioned in SB 47

Conclusion

In conclusion, the future of medical marijuana in Kentucky holds promising opportunities for entrepreneurs. With the recent legalization and improved regulatory framework, there is a growing market for cannabis businesses to thrive. Key takeaways include understanding the licensing process, staying updated on evolving laws and regulations, and developing strategic partnerships within the industry. By navigating these factors effectively, entrepreneurs can position themselves for success in Kentucky’s emerging medical marijuana market.